1. The aging of Japanese business owners

Small and medium-sized enterprises (SMEs) account for 99% of the total number of SMEs in Japan. The current issue facing these SMEs is business succession.

According to the “White Paper on Small and Medium Enterprises 2023” published by the Small and Medium Enterprise Agency, the median age of SME managers was 55-60 years old in 2000, while it was 65-69 years old in 2015, indicating that business succession is not progressing.

In recent years, the Japanese government has been implementing policies in rapid succession, such as revising the business succession tax system and starting a registration system for business succession intermediaries three years ago.

However, the number of small and medium-sized enterprises (SMEs) with managers aged 70 or older has been at an all-time high since 2000, and there is a common understanding within the Japanese government that business succession is the sole issue facing SMEs.

2. Background of Business Succession Issues

Why, then, do business owners think that business succession is not progressing?

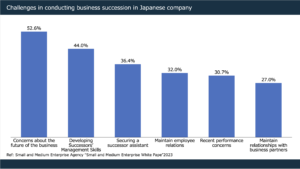

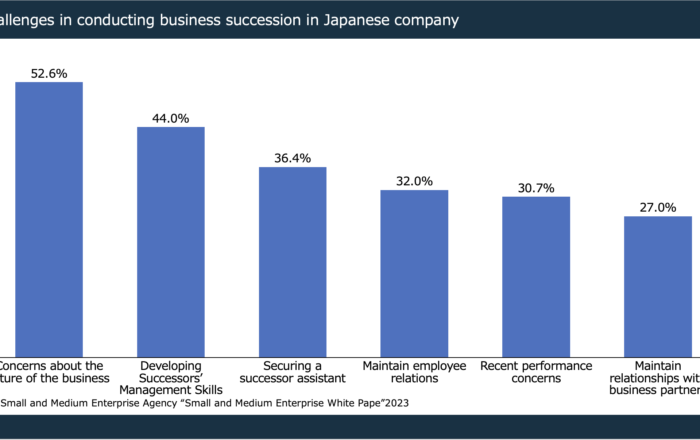

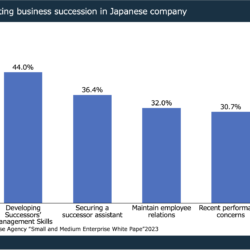

According to the “Questionnaire on Finance, Management, and Business Succession of Small and Medium Enterprises” released in March 2039 by Tokyo Proof Research, a research firm for small and medium enterprises, the most common issue cited by business owners in regard to business succession was “uncertainty about the future of the business” at 52.6%, followed by “fostering the management skills of successors” at 44.0% and “securing human resources to assist successors” at 36.4%. This was followed by 44.0% for developing the management skills of the successor and 36.4% for securing human resources to assist the successor.

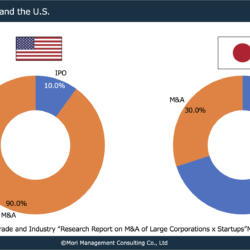

On the other hand, many aspects of these issues can be resolved by grouping in another company through M&A, suggesting that the use of M&A to resolve business succession will continue to gain popularity.

3. M&A Consulting Fees in Japan

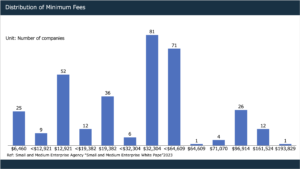

According to the same “White Paper on Small and Medium Enterprises 2023” as in the introduction, the distribution of the minimum fees of registered M&A support organizations indicates that the median minimum fee is $32 thousands among 374 companies.

Although the fees of tax accountants who are familiar with the financial and accounting conditions of SMEs are lower than the median, their knowledge of M&A is limited, and this is another reason why business succession has not progressed for SMEs in Japan.

In response to these factors, M&A platforms with low fees for small companies, which I have been supporting and which have recently started to become popular, can be used to reduce consulting fees.

コメント