M&A Valuation in Japan: Is EBITDA 5x True?

Introduction

When considering the acquisition of a Japanese company, the biggest concern is probably valuation, although of course there is the hurdle of the Japanese language.

Therefore, I will provide a brief explanation of the reality of valuations of Japanese companies based on the data from the survey report and our practical experience.

Survey data

First, regarding M&A valuations for Japanese companies, although the data is a bit old, a text-mining of data from 206 publicly traded companies from 2004 to 2015 shows that EBITDA multiple is 6.3x.

Another book is “Theory and Case Studies: M&A in Japan,” by Nobutatsu Hattori, a visiting professor in MBA classes at Waseda University and Keio University. The book points out that the takeover premium for Japanese companies from 1999 to 2008 was 20%, which is considerably cheaper than the 36% takeover premium in the US.

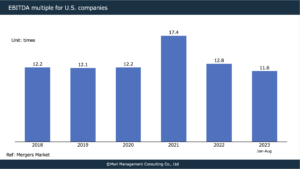

Incidentally, according to Merger Market data, the EBITDA multiple in the U.S. in 2018–2020 was 12.2x, with M&A at 17.2x in 2021 and 12.8x in 2022, although this has settled down to the same level as before.

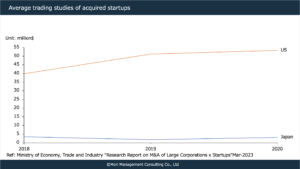

Next, from a different angle, looking specifically at venture M&A, the average acquisition value of Japanese firms in 2019 was 3.1million, compared to 53.3milion in the U.S., a gap of more than 15 times.

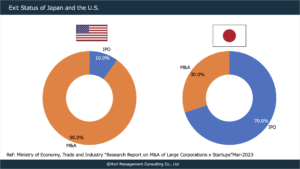

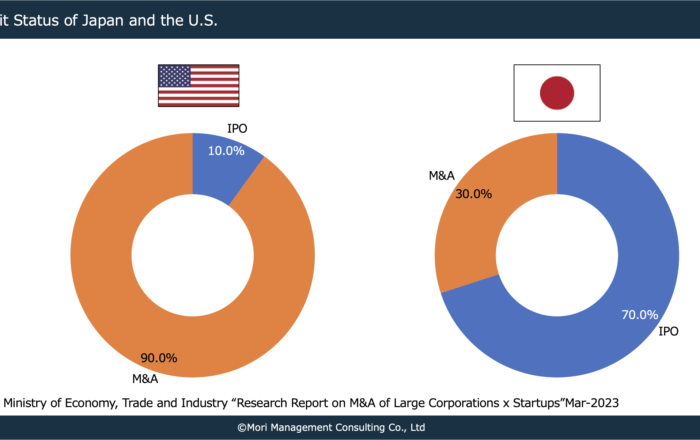

As background, over 70% of venture exits in Japan are IPOs, and M&As are less than 30%, which affects the low valuations of venture companies, the Japanese Ministry of Economy, Trade and Industry (METI) points out in its 2022 “Research Report on M&A of Large Companies x Start-ups,” a research report The report points out.

As you can see from the above, Japanese companies are more undervalued than their U.S. counterparts.

2. Practical treatment

The above figures were only valuations for the addition of large-scale M&A of large companies. In the M&A of companies with sales of several hundred million yen to several billion yen that the author handles, net assets plus three years of operating income and EBITDA multiples are traded at 5 to 7 times in practice. In the case of low-growth sectors such as restaurants, it is often 3~4x.

This is due to the fact that Japanese companies tend to focus on 5x EBITDA multiple from the viewpoint of tax burden, because Japanese companies are less conscious of the risk burden for companies with low growth potential, and because the amortization period of goodwill recorded by Japanese financial associations is limited to 20 years or less, while the tax law allows goodwill to be amortized over 5 years or less.

With EBITDA multiples of 5–7x, Japanese companies can be acquired at less than half the valuations of their U.S. counterparts, which have EBITDA multiples of 12x or more.

3. Our support system

We have over 20 M&A advisory transactions in Japan and have experience in M&A between foreign companies/investors and Japanese companies.

We provide comprehensive support for M&A transactions from sourcing, DD, to closing, and we also offer post-acquisition PMI consulting services, so please feel free to contact us.

コメント