M&A Trends in Japan: 2024 Latest Outlook

1. Trends in the Number of M&As in Japan

According to a survey by the Japan M&A Center, the number of M&A deals by Japanese companies in 2023 was 4,015, a slight decrease compared to 4,304 in 2022 and 4,280 in 2021, but still one of the highest ever.

These figures are based on publicly traded deals only, and if unlisted deals by unlisted companies are considered, the actual number of M&A deals conducted by Japanese companies in Japan is said to be two to three times greater than these figures.

In Japan, 99% of the companies are small and medium-sized enterprises (SMEs), and these SMEs are facing a lack of successors, so there is an increasing number of cases where companies with good businesses and financial strength are being sold.

In recent years, there has been an increase in the number of portal sites that introduce M&A deals like those in Europe and the U.S. However, they are all in Japanese, and many are small deals, making it difficult from the perspective of foreign companies and investors to search for deals one by one.

2. Main features

Mergers and acquisitions (M&A) in Japan continue to increase against the backdrop of a shrinking market due to the declining birthrate and aging population.

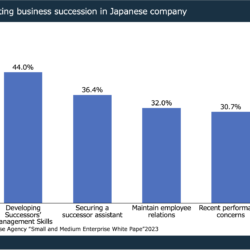

In particular, the shortage of successors in small and medium-sized enterprises (SMEs) has become a serious problem, and business succession-type M&A is becoming more active.

According to the Small and Medium Enterprise Agency’s “M&A Issues for Small and Medium-Sized Enterprises and Small Businesses,” of the 1.27 million companies that specifically lack successors, 600,000 are said to be profitable.

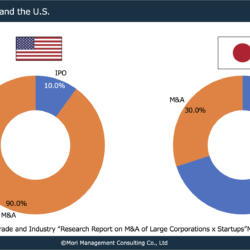

Furthermore, even among large companies, M&A activity is increasing for the purpose of restructuring existing businesses or entering new businesses. In recent years, acquisitions of start-ups have also increased in recent years. Behind this trend is the need to respond to the rapidly advancing wave of digital transformation (DX) and technological innovation. Large companies are increasingly seeking to develop new businesses and strengthen the competitiveness of existing businesses by incorporating the technology and know-how of startups, especially in the fields of IT, artificial intelligence (AI), fintech, and health tech.

For large companies, acquiring a startup is an effective way to bring in innovation in a short period of time, but it also has advantages for the startup, such as increased business scale and stable funding. On the other hand, post-acquisition integration is often challenged by differences in culture and decision-making processes between the large company and the startup, so it is important to create a framework for smooth post-acquisition collaboration.

In addition, startup acquisitions sometimes proceed in the form of third-party acquisitions supported by investment funds and venture capitalists as well as large corporations, helping to revitalize the startup ecosystem in Japan.

Thus, startup acquisitions are attracting attention as a new trend in the domestic M&A market, and it is an area that will continue to be closely watched.

3. Our Consulting Program

We provide M&A advisory services to Japanese companies with a unique business environment and high barriers to entry in the Japanese language.

Under the leadership of a representative who has experience establishing an M&A advisory firm, we provide total support for the acquisition of Japanese companies. We support our clients from the identification of a deal to pre-negotiation, DD, and closing. We also provide support for PMI, including recruitment of human resources in Japan, which can be discussed separately.

Please feel free to contact us for more information.

コメント