1. Overview of Japanese M&A platforms

Around 2020, platforms for listing small M&A deals began to proliferate in Japan.

Initially, Japan M&A Center, an M&A intermediary company, opened a website (BATONZ) to allow its partner tax accountants and others to post small deals that it did not handle.

Even with the increase in the number of platforms, there are only three to four major sites where projects are gathered.

①BATONZ

②tranbi

③Bizreach Succeed etc.

2. Current status of projects posted

In this issue, we will post our analysis of what kind of deals are being registered on the major platforms, focusing mainly on deals with transfer consideration ranging from 10 million yen to 300 million yen.

In conclusion, we find that many small-scale deals with sales of around 100 million yen and operating income of around 10 million yen are registered.

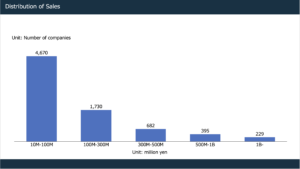

2-1. Sales Distribution

① Sales of 10 million yen to 100 million yen: 4,670 cases

②Sales of ¥100 million to ¥300 million :1,730 cases

③Sales 300 million yen to 500 million yen: 682 cases

④Sales of 500 million yen to 1 billion yen: 395 cases

⑤More than that: 229 cases

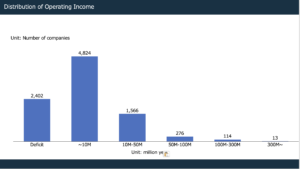

2-2. Distribution of operating income

①Deficit: 2,402 cases

②Operating income less than 10 million yen: 4,824 cases

③Operating income of 10-50 million yen: 1,566 cases

④Operating income of 50-100 million yen: 276 cases

⑤Operating income 100-300 million yen: 114 cases

⑥Operating income of 300 million yen or more:13 cases

3. Our response

We provide advisory services in all phases, from initial sourcing of projects utilizing various platforms, to negotiating with buyers in Japanese on behalf of the client, to closing the deal.

We also have an agency system to introduce buyers, so please feel free to contact us.

コメント